About the Industry

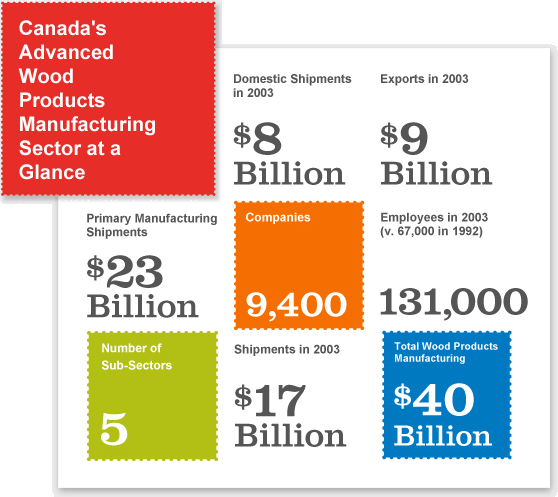

Canada's advanced wood products processing sector is large and growing. It makes a significant contribution to the Canadian economy through the numerous businesses and enterprises that make up the sector, the large number of people who earn a living working within it, and the wide variety of products produced and sold to customers worldwide. Advanced wood processing is comprised of five sub-sectors - furniture, cabinets, windows and doors, millwork, and factory-build housing and building components. Within these sub-sectors there are over 9,200 companies.

The sector is diverse and includes a substantial number of furniture manufacturers - ranging from household to office furniture, and producing casegoods and ready-to-assemble products. These products have various channels of distribution and ultimately are focused on the final consumer.

Canada's forests represent the third largest supply of wood-related natural resources worldwide, ensuring a continued source of materials for advanced wood products. The sector serves a sizeable domestic market, but nearly half of its output is focused on export markets. It exports a significant volume of products - mainly to the United States, but also to Japan and smaller volumes to several other markets. The total value of the sector's manufacturing shipments was estimated at around $17 billion in 2003. The value of its exports at that time was around $8 billion.

Canadian Wood products manufacturers are experiencing an acute shortage of employable people. This is a common and urgent concern among firms of all sizes, and within all sub-sectors. The wood products sector is not alone. Manufacturers in many other parts of the economy also are extremely concerned about this problem.

A recently commissioned Wood Manufacturing Council Human Resource Sector Study identified a range of employment and labour market issues related to the apparent shortage of labour including an acute shortage of vital skills. Based on extensive interviews with advanced wood products manufacturers and related parties carried out as part of this study, the study concludes that the 'skills gap' is due to a wide range of direct, indirect and frequently interlinked factors.

General Occupational Skills Most Frequently Identified by Firms as Being in Immediate Short Supply

- Engineering

- New Product Development

- Materials Handling

- Packaging

- Product Assembly

- Logistics & Transportation (e.g. Forklift Operating through Shipping)

- CNC Programming

- CNC Operating

- Computer Skills (Enterprise-Wide)

- Management of Intelligent Systems / Robotics

- Interpretation (e.g. Ability to Read Blueprints, Computer Interface Data Analysis)

- Preparation of Documentation, Report Writing, Presentations

- Scheduling, Purchasing

Skills Sets Most Frequently Identified as Important in Management:

- Leadership

- Numerical

- Mechanical (i.e. manual dexterity)

- Marketing & Sales

- Communications

- Technical

- Drafting & Design

The impacts are significant. Some manufacturers identify the lack of labour flexibility and mobility as the most immediate cause of their inability to expand their business. Others report that labour and skills shortages are preventing them from modernizing. They want to use more equipment, but can’t find qualified operators.